Blog

Fed Rate Hike (Finally) Likely Next Month

14 of 17 FOMC members expect a rate hike before the end of the year, so it’ll probably happen in December. Last time they did this (Dec ’15) mortgage rates actually dropped. The economy can’t support higher rates. The high end market has slowed dramatically recently, and price gains are slowing nationwide.

See DS News article here.

New Fun Way To Find Houses Sans Realtors

Haus was started by the guy who founded Uber. They don’t have every house on there yet, but when they do this will be big.

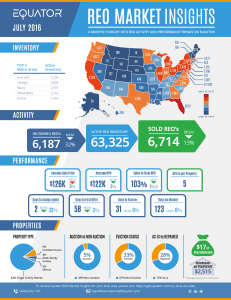

Nationwide REO Picture for August

Exclusive Report for Equator Agents:

MARKET INSIGHTS

August 2016 Activity

Equator REO

Understanding your market is essential to being a successful REO Agent.

Here, we provide the latest Equator REO data and intelligence we have on our system. Our goal is to help you succeed in REO so you can become the highest performing agent you can be.

(Click picture for full story)

July Home Sales Slow, and Prices Dropped a Bit Since June

Real Property Report – California, July 2016

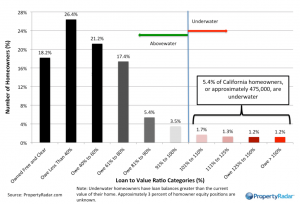

California’s Underwater Homeowners Fall Below 500,000, Down 50 Percent from July 2014

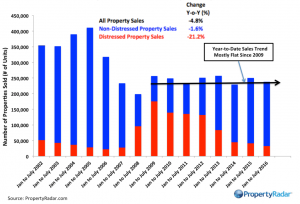

July Sales Dive 12.8 Percent Y-o-Y, or Did They?

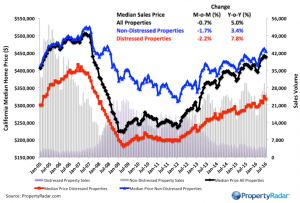

California Median Price Edges Lower in July, but still Up 5.0 Percent Y-o-Y

“At first glance, it looked like July sales fell off a cliff,” said Madeline Schnapp Director of Economic Research for PropertyRadar. “Looking closer at the data, we noted that July 2016 had two fewer business days than July 2015. That calendar quirk was enough depress July sales. When the missing days were taken into account, the sales decline was approximately 3.0 percent for the month and 5.0 percent for the year, in line with expectations.”

“The silver lining to rising prices is in the past two years 575,000 California homeowners have escaped their negative equity prisons,” said Schnapp. “Now armed with positive equity, these homeowners can take advantage of near record low mortgage interest rates to refinance, sell an existing home and buy a new one.”

June Home Sales: HOT!

Despite all the chaos in the world, the 2016 real estate market is looking like a carbon copy of 2015:

Real Property Report — California, June 2016

Year-to-Date Sales Nearly Unchanged Since 2009

Median Price Hits 9-Year High, Up 6.3 Percent from June 2015

Cash Sales Remain Strong Despite High Prices

|

“Sales have trended mostly sideways for eight consecutive years,” said Madeline Schnapp, Director of Economic Research for PropertyRadar. “While sales volumes appear to have hit a ceiling, prices continue to reach new heights. Lack of inventory, near record low mortgage interest rates, and increase in demand due to California’s continued economic vitality are pushing prices higher.” |

“The increase in home prices is not surprising given the fact that new housing inventory is difficult to deliver within California’s burdensome regulatory environment,” said Schnapp. “While inventory remains constrained, California’s economic growth engine continues to churn out an impressive number of new jobs, 448,000 in 2015, driving up demand. That, combined with investors buying real estate to shelter cash, continues to push up prices beyond reasonable levels.”

VIEW THE ENTIRE REPORT PLUS ELEVEN VISUAL CHARTS COVERING:

Home Sales, Year-over-Year Home Sales, Median Sales Price vs. Sales Volume, California Home Owner Equity, Cash Sales, Flipping, Market Purchases by LLCs and LPs, Market Sales by LLCs and LPs, Trustee Sale Purchases by LLCs and LPs, Foreclosure Notices and Sales, Foreclosure Inventory.

Brexit Helps L.A. Market

Vacancies drop, rents rise and Brexit keeps interest rates low. See details in LA Biz.

April Sales Chart Porn

Property Radar’s economists are always overly pessimistic (they’re in the business of selling info on foreclosures to investors) but their charts make me swoon.

Sorry, no bubble here

A lot of people are saying we’re in another real estate bubble, but the truth is not even close. 2016 could hardly be more different than 2006:

1. Inventory is extremely low.

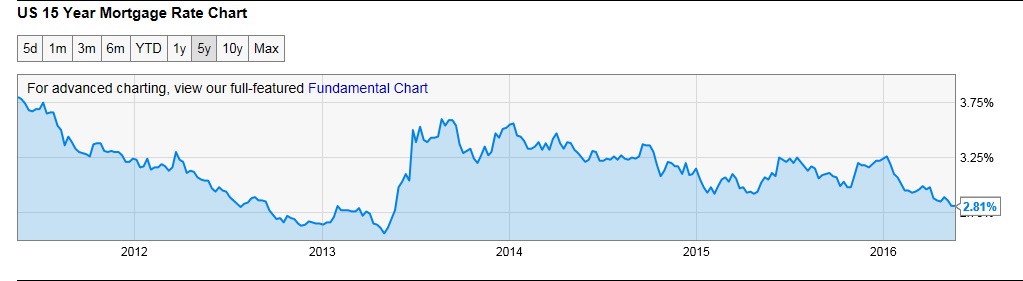

2. Interest rates are the lowest ever, and will continue to drop.

3. All the loans funded in the last 8 years are quality (i.e. borrowers actually had to qualify and put money down).

4. Foreclosures are down 23% from last year, and the delinquency rate is 3%.

Low inventory, low rates and decent demand is the perfect formula for continued appreciation. Yes, a recession is coming, eventually. It is a natural part of the business cycle. But when it does, it will be nothing like the last one. Real estate will be the safest place to be, and when the recession ends it will shoot up again, like it always does.

30 year fixed drops to 3.58%

For 4 years economists have been promising higher mortgage rates, and for 4 years rates have slowly dropped. I can’t find a graph to prove it, but rates are as low, or lower, than they’ve ever been. Despite all the talk about prices being too high, people will look back and wish they’d bought in 2016.